We are now Commissioners for taking oaths, signing affidavits and declarations.

Steps to success

Do you have Quickbooks Online? Want to save money? Email us for a QBO discount link. We are here to help.

Bookkeeping Tips to Help You Manage Your Money with Skill

Keep business and personal banking separate:

All new business owners must make it a priority to open a new bank account for their business, preferably an account with online access, to keep business funds separate from personal funds.

Processing transactions for your personal expenses within the bookkeeping of your business is a waste of precious time.

It’s even worse if you are outsourcing and paying a bookkeeper to process your accounts with these personal expenses mixed in…

… And they will have to be processed if they are mixed up with the business transactions. They have to be entered into the bookkeeping system and coded to drawings, taking up precious time that the bookkeeper could just spend entering business data.

If you need to use business money for personal expenses, just do a bulk transfer to your personal account on a regular basis like once a week so that the bookkeeper isn't having to deal with many small personal transactions and making you pay for their time.

HST bank account:

Open a business savings account and set aside money from your business earnings every month to pay your quarterly tax. You can periodically check what you owe for HST in your accounting software so you can ensure you have transferred enough.

Bank accounts with online accessibility is definitely the way to go now. It is quicker and easier to login online to make payments and keep up with the bank reconciliations in your bookkeeping software, than to wait for the bank to post a statement, or writing out cheques to make payments.

Hire a bookkeeper:

Outsourcing your bookkeeping instead of a DIY situation will be worth every penny. You focus on your business and making money and let the bookkeeping experts do what they do best. Ensure that you are hiring a professional certified bookkeeping firm.

Outsourcing is...

Cost Effective: Because you only need to pay for a couple of hours of work a month as opposed to paying a regular wage and the applicable payroll taxes, and

Accuracy: You are getting that necessary professional work done on your accounts so you can be confident they are correct.

It can take a professional bookkeeper less time to process one month’s worth of bank transactions, finalize a bank reconciliation, and produce a set of reports instead of you carving out the time to do it.

The great thing about experienced professional bookkeepers is that they are usually in a position to give you great business advice over and above your day to day bookkeeping needs.

Organize your business documentation:

Keeping the documentation for all business transactions is a high priority. They are called accounting source documents. Keeping them enables:-

- Easy tracking for any future queries that might pop up, and

- Proof (to an auditor or tax man) of what occurred.

Most tax departments require businesses to keep the documents that back up their tax claims for a minimum of 5 and often 7 years. These are documents such as invoices, receipts, wage records, etc. Search the internet for your local tax department website and type in something like ‘how long to keep records’.

The only way to keep the records is to have a very well-organized filing and archiving system. A box or basket full of randomly placed papers makes it much harder to locate what is needed, and will cause an unnecessary waste of time not to mention frustration.

There are three basic filing options available -

i) the paper system,

ii) the electronic system on your computer's hard-drive,

iii) online documentation storage.

Keep track of cash payments:

Any cash received should be paid into the business bank account before spending it.

It can be tempting to take the cash right away to purchase supplies but this might cause a mess in the bookkeeping system.

For example, the bookkeeper/owner might:

A) Forget which customer paid the money which can lead to some embarrassment if the customer is contacted some weeks later for payment...and they have already paid! It could

also appear as tax evasion because the income is not being declared in the system.

B) Forget to include the purchase in the books - these expenses definitely need to be entered in to the accounts to help keep your taxes down! Being forgetful about the above will result in the bookkeeping system not reflecting a true record of what has occurred.

Learn to understand monthly bookkeeping reports:

It’s surprising how many business owners have no clue if what they are doing is working until it’s too late i.e. they suddenly find themselves with no money and huge debts.

You can avoid this scenario by being pro-active about keeping your bookkeeping system up to date and producing reports at least once a month.

Learn how to read and understand those reports. If you are going to own and run a business you can’t ignore this aspect. The two important reports to start with are the Income Statement and the Balance Sheet.

Keep on top of your sales invoicing:

There is nothing worse than having a job done by someone, like a plumber, and then waiting for months for an invoice. Most conscientious people would like to get the bill paid. It is extremely annoying having to call up a supplier to ask where the bill is. This appears as dis-organization to the customer, and from the plumber’s perspective can be detrimental to the business cash flow.

As soon as a job is complete, or at least by month’s end, prepare and send out the customer invoices so that the income can start rolling in, thus keeping the bank balance healthy and enabling payments to suppliers to be made when due.

The importance of invoicing customers in good time is a lifeline for the business because this is where the money is at. Keep at it and be organized about it! Of course, this does not apply if the business is operating on a cash basis without extending credit to the customers because the cash will be coming in at the time of sale.

Pay your employees on time:

If you employ people in your business make sure you do the responsible thing and pay their wages or salaries on time. Employees rely on being paid on time to eat and pay their bills.

With each pay run, make sure you set aside savings to cover the payroll tax from the employee’s pay. This is not your money - it belongs to the government.

Make sure you file your payroll returns on time and make the payments on time. Don’t ‘forget’ to do these things. Filing or paying late can incur fines for your business (a real waste of your business funds).

So get the timesheets to your bookkeeper in time for payroll. If you give it to them at the last minute, you are thereby expecting your bookkeeper to drop everything and get your payroll done. Remember: Your lack of organization does not constitute an emergency on the part of your bookkeeper.

Why paying your bills on time makes sense:

When a business runs short of cash, it's common for the owners to start paying bills late—sometimes even federal and state taxes.

First, you should know that skirting tax obligations is an absolute no-no and a sign that you may be at (or past) the point where you should close down.

Saving Your Good Name

The cost of paying on time is low as compared to almost anything else you can do to maintain a good reputation in your business community. When you pay late, you damage your credibility, something that is crucial to preserve in tough economic times. To survive, your business will eventually have to pay its debts, so by putting them off a few months you gain nothing but risk losing your good reputation.

Saving Money

Paying early can get you discounts that net you more cash then you could earn in interest by holding onto the money longer. Don't be shy about asking for deeper discounts than your vendors initially offer.

Keep in mind that it's not just your satisfied customers (people who pay you money) who tell others about your business.

All the people who work for and with you can also be powerful recommenders. This includes everyone you cut a cheque to, from your landlord and insurance broker to the owner of the restaurant down the street that occasionally caters your meetings. If they feel positive about your business—something that is greatly aided when you pay their bills promptly—each can become a significant marketing ally.

FORE

Maybe CRA does not know how to golf!

Perception is reality, especially Canada Revenue Agency’s perception of legitimate business entertainment versus pleasure.

Traditionally, the CRA has taken a very strict view on entertaining clients, employees, and suppliers at clubs, camps, lodges, golf courses, and on yachts. Unless your business involves the ownership and renting of a club, camp, lodge, yacht or golf course, as a general rule, no deduction is permitted relating to the use of these facilities. Therefore, if you take a client out for a round of golf, you cannot deduct the cost of that round in your business for tax purposes. Even though business may be discussed on the course, and you may have even closed a deal, you cannot deduct the cost of the green fees or membership.

When it comes to golf course green fees, the rules are very clear. Golf is considered a recreational activity and therefore the expenses related to that activity are not tax deductible.

As the entertainment of key clients, suppliers and employees is becoming such an important aspect of doing business, an informal war has developed between taxpayers and the CRA concerning what is considered an acceptable deduction for entertainment expenses.

CRA also used to take the position that any meals or entertainment of clients, employees, suppliers, etc. at a golf facility were not tax deductible; further, the cost of green fees were also not deductible. You could actually drive away from the golf course and return a moment later to have a meal and that was allowed at the usual 50% rule.

This policy position lead to a somewhat confusing and inconsistent result: should a business owner have dinner with a client across the street, the meal would be deductible, but in the golf course dining room, there could be no deduction.

Obviously, many golf course owners were concerned and affected by this interpretation. Fortunately, the CRA reconsidered its position and has now agreed to allow the deductibility of business meals and entertainment expenses incurred at a golf course, subject to the 50% limitation rule. (Green fees remain non-deductible.) This is good news for both owners of businesses and golf courses. However, to ensure you get to deduct the cost of entertaining your clients, make sure that the meal and beverage expenses are clearly noted on your bill or receipt. If your receipt is all inclusive without a breakout of the cost for meals and beverages, the CRA will disallow the entire expense.

MILEAGE

Invoicing Your Client For Your Mileage

As per the Canada Revenue Agency, there is GST/HST included in mileage rates and mileage being charged to a client is considered income.

For provinces that do not participate in the Harmonized Tax program, the mileage rate will only include the 5% GST tax rate.

For participating provinces, the mileage will include 11-15% HST depending on the province.

When invoicing a client for the mileage driven on their behalf (in order to provide the goods/services) you need to break out the tax. Once you have the pre-tax rate you multiply that by the number of kilometers driven and then apply the tax.

Example: Ontario – if you are charging $0.52 per kilometer…

16 kilometers driven

$0.52/1.13 = $0.46

$0.46 is the pre-tax amount

16 kms x $0.46 = $7.36 x HST = $8.32

expenses you can not claim

Items that are not tax deductible as per the Canada Revenue Agency

There is often much confusion over what is an allowable business deduction. We've compiled a list

of the expenses that our clients ask us about the most. So we are sharing the CRA rules right here for each of those expenses.

Clothing Purchases

You want to look your best while running your business, especially when you have to meet with clients or customers. That means investing in clothing, makeup, and grooming, though you can’t claim these costs as independent contractor business expenses. This also means you can’t claim a deduction for coveralls, special shoes, gloves, or work wear. However, if your employer reimbursed you for these coveralls, etc then it is not considered a taxable benefit for you in regards to your taxes.

Workday Snacks

If you buy snacks to eat while you you work, you can’t deduct them. The CRA does make an exception for self-employed bicycle couriers and rickshaw drivers, though. If you work in one of these professions, the CRA views some of your daily snacks as fuel to keep your transportation going. As a result, you get to claim a deduction just like truck drivers claim a deduction for petrol. You can claim a flat $17.50 for snack money for every eight-hour shift you work.

Dining Out

When you work from home as an independent contractor, you might want to get out for a change of scenery sometimes. Keep in mind that if you work from a coffee shop for the day, you can’t claim the coffee and pastries you consume as business expenses. But if you meet a customer at an eatery or take clients to a show, you can write off 50% of the meal and entertainment expenses as long as you discuss business. In addition, if you travel for your business, you may also write off half your food costs while on the road.

Personal Expenses

You can’t write off personal costs as independent contractor business expenses on your tax return. If you buy paper and pencils for your children to use, you can’t write off those costs as office expenses. Similarly, if you buy a computer or office equipment for personal use, you can’t claim it as a business expense.

Lucky for you, the CRA has a process in place for purchases you use for both business and personal matters. This lets you figure out which portion you use for business and write off that percentage of your expense. For example, let’s say you buy a computer you use 80% of the time for work. This means that 80% of its costs counts as a business expense.

Maintenance and Repairs

When it comes to deducting business expenses for repair and maintenance, you can’t deduct:

- The value of your own labour

- Costs you incur for capital expense repairs

- Costs you incur for repairs your insurance company reimburses

Keep in mind that you can deduct labour and materials costs for minor repairs or maintenance of property you use in earning business income. For instance, if you pay someone to repair the cracked screen on your business smartphone and you don’t have insurance coverage, you can deduct that expense.

Receipts

Cash registers and credit card machines often print out receipts on thermal paper containing a wealth of information, including detailed description of the items purchased, the date and time purchased, and the price. The issue with these thermal receipts is that they fade over time. If you refer back to them months or years later to verify a purchase, you might have a problem reading the faded receipts. In order to circumvent this problem, I am recommending that you photocopy each thermal receipt. This is imperative to do in the event that you have to justify an expense to the Canada Revenue Agency.

Another method to save these thermal receipts for future viewing is to store them electronically. According to the Canada Revenue Agency website, your receipts:

o Must be kept in Canada unless permission is granted to keep them elsewhere;

o Must be made available to a CRA representative upon request;

o Includes electronic records that are created and maintained by computerized record-keeping systems.

o CRA considers you to have electronic records if you create, process, maintain, and store your information in an electronic format.

o It must be an accurate reproduction with the intention of it taking the place of the paper document.

o It gives the same information as the paper document.

o The significant details of the image are not obscured because of limitations in resolution, tonality or hue.

o The electronic records must be kept in an electronically readable format.

o Scanned images of paper documents, records, or books of accounts that are kept in electronic format are acceptable if proper imaging practices are followed and documented.

o If a gasoline receipt has been issued, it must have the vehicle odometer reading written on it.

o If a client or customer has been taken out for a meal, the receipt must have the name of the client, name of the company and contain contact details including phone number.

As I have illustrated above, it is important that you either photocopy or scan your thermal receipts. The onus is on you to do this on an ongoing basis. I recommend that you do this on a daily basis in order to better manage this task.

Employee Gifts

CRA (Canada Revenue Agency) Tax Rules for Employee Gifts

The general CRA rule is that all gifts given to employees are considered to be taxable benefits by the Canada Revenue Agency except for the following exemptions:

- Employees may receive up to $500 (in fair market value) of non-cash gifts in a year.

- Employees may receive a non-cash gift in recognition of long service valued at less than $500 once every five years.

- Employer-provided parties or social events where the cost is $100 per person or less.

- Meals or other hospitality services at work-related functions, such as meetings, training sessions, etc.

- Valueless items such as coffee/tea, snacks, mugs, t-shirts, hats, etc.

The annual and long-service awards are considered to be separate, that is both may be received in the same year.

Anything above the $500 amount in either case is considered to be a taxable benefit, for which the employer may have to make source deductions.

Benefits

- There is no limit to how many gifts an employee receives during any given year;

- Small gifts don't count. Mugs, chocolates, plaques etc. are not included in the $500 limit.

There are certain restrictions, however. If you want to use your employee gifts as tax deductions in Canada you must:

Be careful what you give as an employer. Items such as gift certificates or stocks that are easily converted into cash will be considered as taxable employee benefits by the CRA, as will performance-related awards and bonuses. This includes:

- Gift cards/certificates.

- Rewards that involve employer-provided meals or accommodation. For example, as a bonus you send an employee and his family on a trip to Disneyland.

- Cash or non-cash awards from manufacturers given to dealers that are passed on to employees.

- Points for travel, accommodation and other rewards.

- Gifts given by manufacturers to employees of dealerships.

Customer Gifts

CRA (Canada Revenue Agency) Tax Rules for Customer Gifts

According to the CRA, you may deduct all reasonable business expenses from your business income on your tax return, and entertainment and meals qualify as business expenses if they are incurred in the pursuit of establishing or maintaining clients.

If you give a client a gift certificate to a restaurant or a pair of tickets to a hockey game, those gifts are considered to be meals and entertainment expenses; as a result, you may write off half of their value. Keep the receipts for your records and a few notes indicating how the expense was business related with the customers name and contact details including telephone number written on the receipt. In some cases, you may also be able to claim 100 percent of the cost of client gifts as an advertising or promotional expense.

Itemized Receipts

Itemized receipts are mandatory for claiming business expenses

Receipts must be itemized in order to be considered a valid business expenditure. An itemized receipt shows the items that were purchased and price associated with that item. If the item on the receipt is not obvious as to what it was that you purchased, then you must write on the receipt what that item really is. Often stores use SKU numbers or parts reference number and if you do not write down what it is, then you will not be able to claim it as an expense to the business.

At times the cashier will give you a credit card payment slip. This does not qualify as an accepted receipt because it does not indicate what was purchased.

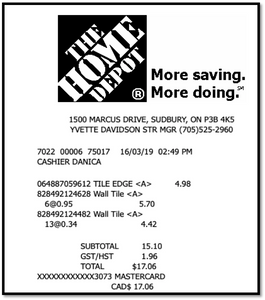

To the left is a GOOD receipt.

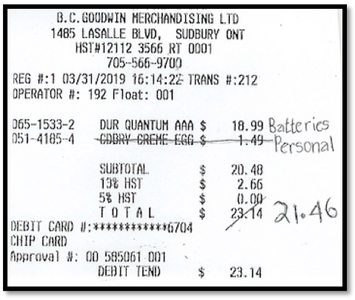

Bad Receipt

This is a bad receipt but it has been corrected.

There are 2 things wrong with this receipt.

1 The first item is not clear as to what was purchased.

2 There is a personal item on a business receipt.

Write beside the items that are not clear explaining what you purchased.

Cross off all personal items and deduct those from the total.

Only the business- related items are allowed to be expensed.

Going forward, pay for personal items separately.

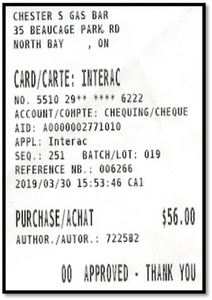

Bad Receipt

This receipt does not say what you purchased. Even though it is a gas station receipt, you can purchase more than fuel at a gas station. You must prove what you purchased.

Getting Paid Faster

Tips To Help You Get Paid Faster

Does this sound familiar? You sold a product or a service and your customer has yet to pay. We have all experienced this. Companies spend a lot of time chasing customers for payments when their time would be better spent acquiring more business.

Then there are the customers that are habitually late. You send out the invoice and then a statement marked 'Past Due'. You pick up the phone to call them to hear promises that they will get that payment out promptly. Another week goes by and unless the mailbox ate the cheque; it was never sent.

Under most circumstances I think it makes sense to give customers the benefit of the doubt; most really are well-meaning people or companies who intend to, and usually do, pay you … eventually. Their habitual late payments, however, can hurt your cash flow. That’s bad for the financial health of your business, so you’re wise to take action to nip the problem of late payments in the bud and prevent new clients from becoming late payers.

Where do you begin? By using one or more of the following tactics, which can help motivate your clients to pay on time:

Choose the right payment terms

You should add two weeks to estimate the actual date when you’ll receive payment. For example: If you want to get paid in 30 days, consider using payment terms of 13 days or less.

For the service industry, consider C.O.D. Once the service has been fulfilled, complete an invoice in front of the customer, either electronically or pen to paper, then request payment before leaving. Once you leave, it is so easy for the customer to come up with ways to wiggle out of paying the bill by searching for something to complain about. However, if you are in front of the customer and hand them an invoice, that is their opportunity to voice any concerns and are more likely to pay if you have your hand out requesting payment for services rendered.

Don't delay

Ensure that invoicing gets out the same day or the very next day. Any delays will add to the delays in payment.

Offer a small discount for paying early

A little positive reinforcement might help you get paid on time. Consider offering clients a discount of 1 or 2% if you receive their payment a certain number of days before the invoice due date.

Institute a late payment fee

Unfortunately, not all customers will be motivated at the prospect of saving money. They might pay up on time, however, if paying late comes at a cost. Even an amount as small as 1.5% might grab their attention and get that cheque in the mail.

Give the option to pay electronically online

By enabling clients to pay instantly through an online payment service like PayPal or E-Transfer, you make it more convenient to pay. And it allows customers who are short on funds to pay using their credit card if they choose PayPal. That way, you’re not stuck waiting until they have money in the bank.

Accounting App

Download an accounting app onto your phone so you can do an invoice while still with the customer and you can email it to them immediately. This saves on all the costs involved in mailing an invoice. And yes, ask for payment while you are still in their presence.

Send a gentle reminder when an invoice is a week past due

In many cases, invoices simply get lost in the shuffle. By politely following up with clients after invoices are a week past due, you can put them back on your customers’ radar.

Do not do more work for the client if their account is 30 days past due

Tough Love. Sometimes temporarily ceasing to provide services or products is the only way to get a client to understand that they don't have options.... they must pay you.

Pick up the phone

An invoice and/or a statement that arrives in your Email's inbox or the mailbox at your home or business is easy to ignore. A friendly phone call asking when you expect payment can often produce better results. Yes, then there are those customers who will tell you whatever you want to hear just to get you off the phone.

Road trip

If possible, go to your customer's place of business. Yes, walk right in and ask to speak to the owner. In my experience this does produce immediate results in most cases. They can't ignore your invoice or phone call when you are face-to-face with them. This goes back to my earlier point of requesting payment as soon as the service is complete. You can't walk into a clothing store, choose a sweater and walk out citing that you pay later.

While there’s no guarantee any of these will in every case prevent late payments, they will work with some customers—and you’ll have the peace of mind knowing you’re doing what you can to alleviate the issue.

Regardless of how you decide to go about minimizing the problem of late payments, make sure you’re upfront about your payment terms and conditions in your client agreements and on your invoices. Communicating clearly and allowing no room for misinterpretation gives you leverage when following up with clients who have run behind on paying.

I also encourage you to never, ever underestimate the power of maintaining harmonious professional relationships with your clients. Regardless of how frustrated you may be, keep your cool and remain respectful when checking on invoices that have gone overdue.

Getting paid faster from your customers